Sustainable Finance: Taxonomy

The European taxonomy sets out classification criteria for sustainable investment. Adequate evaluation of project/real estate sustainability, in the light of the new EU standards, is thus key to securing future investment. In order to facilitate this transition, a timeframe has been set for ensuring alignment will the regulations that will come into effect, namely regarding specific product strategies and more encompassing Environment, Social & Governance (ESG) strategies.

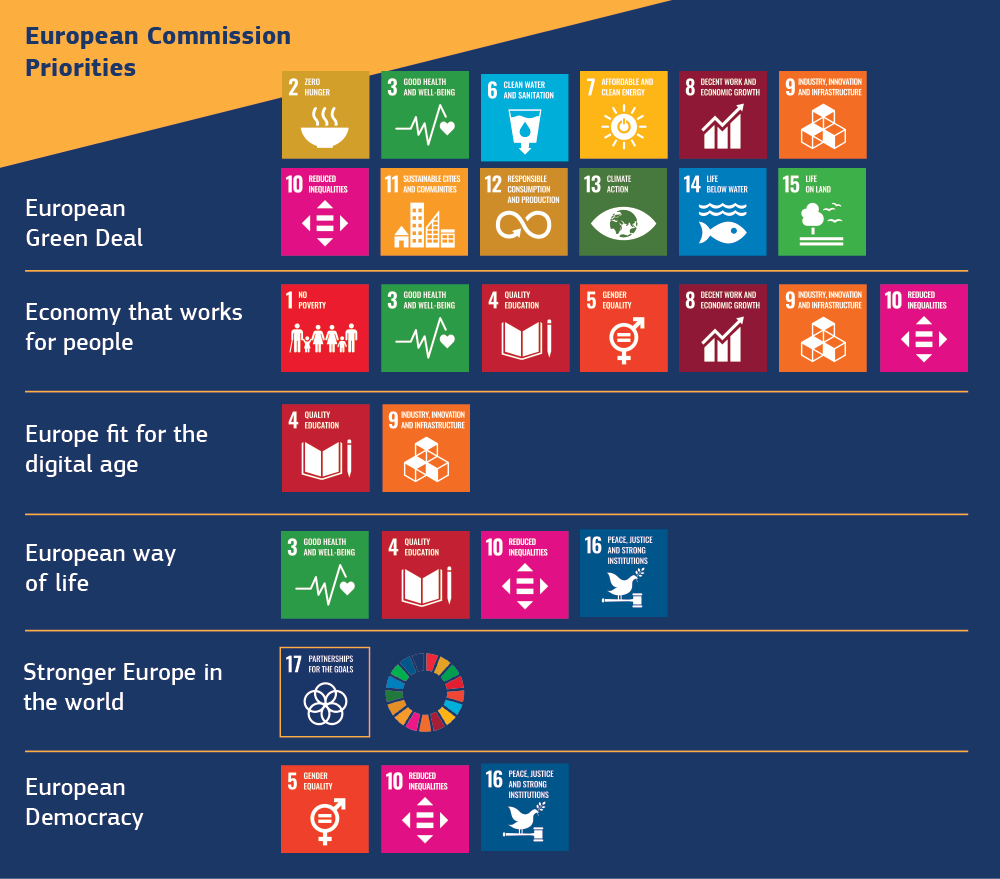

The Taxonomy Regulation came into force on 12 July 2020 for the purpose of defining Environmentally sustainable activities. This regulation seeks to define and foster sustainable investment by promoting the implementation of the European Green Deal, whose goal is to ensure that Europe will be the first continent to achieve net-zero climate impact.

Taxonomy is already playing a key role in the European economy, as the European Commission has already defined a set of tools aimed at ensuring economic transition, namely corporate sustainability reporting, whereby companies are required to report their practices in a transparent, comparable manner, including mandatory information on alignment with the taxonomy, investment in climate and environmental transition, and sustainability risks, for the purpose of providing investors with the necessary data to evaluate the environmental objectives and performance of financed activities.

In this sense, a common sustainable investment concept is defined, from an environmental perspective, through the introduction of universal criteria applicable to the European financial market, of which the most relevant are the following:

a) Making a substantial contribution to one or more of the environmental objectives, by meeting the corresponding technical evaluation criteria;

b) voiding significant harm to the remaining environmental objectives.

The Taxonomy Regulation establishes 6 environmental objectives:

Climate Change Mitigation;

Climate Change Adaptation;

Sustainable use and protection of water and marine resources;

Transition to a circular economy;

Pollution prevention and control;

Protection and restoration of biodiversity and ecosystems.

Criteria for “substantial contribution” and “no significant harm” have been defined for each objective, according to the economic activity in question (Construction and Real Estate in the present case). Within this framework, building sustainability assessment, according to the EU taxonomy, will represent a key condition for attracting investment in the near future.

In addition to helping clients evaluate whether a given asset (future project or existing asset) is sustainable, Engexpor provides assistance with the creation of a roadmap for climate and environmental transition.